Weekly Propane Pricing Shifts Across PADD Regions

Weekly Price Movement Drives Daily Decisions

Weekly propane pricing data often gets dismissed as background noise, but for operators managing margin, supply risk, and customer communication, those week-to-week moves matter more than many admit. Residential and wholesale prices do not move evenly across the country, and PADD-level differences can quietly reshape buying behavior, transport costs, and exposure during the heating season. For propane businesses, especially those balancing contract gallons with spot purchases, understanding how prices are behaving by region is less about market watching and more about protecting cash flow, service reliability, and operational flexibility.

Wholesale Pricing Divergence by PADD

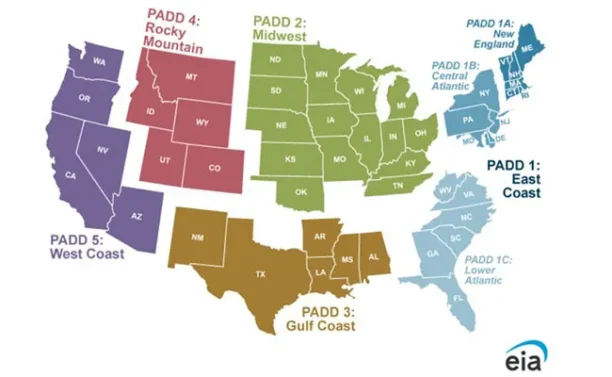

Recent data shows familiar but widening gaps between PADD regions. PADD 2 prices have remained relatively firm compared to the Gulf Coast, reflecting tighter regional logistics and continued dependence on rail and pipeline movements from storage hubs. In contrast, PADD 3 wholesale prices have stayed more restrained, supported by strong production and export-linked flow dynamics that tend to keep Conway and Mont Belvieu differentials active. These gaps matter operationally. A five- to ten-cent swing at the rack changes the economics of pre-buy commitments, affects which terminals get favored, and alters exposure if winter weather tightens transport availability faster than supply.

Residential Price Movement and Margin Pressure

Residential pricing has shown slower adjustment than wholesale in several regions, which is not unusual but still risky. In colder-demand areas, businesses often hesitate to move retail prices mid-season, even when wholesale costs climb. The result is margin compression that does not show up immediately on paper but becomes obvious by late winter. PADD 1 and parts of PADD 2 continue to reflect higher delivered costs tied to longer hauls and weather sensitivity. Weekly tracking allows managers to spot when retail prices are lagging too far behind replacement cost, especially for will-call customers who buy at peak demand.

Operational Risk Beyond the Price Itself

Price movement is rarely the only variable in play. Rapid wholesale increases often coincide with longer terminal wait times, tighter driver availability, and higher exposure to safety incidents under pressure. Dispatch decisions get harder when price volatility pushes more customers into emergency deliveries. Insurance and compliance risk rise when crews rush to protect margins by squeezing more stops into already tight routes. Weekly pricing trends act as an early warning for when operational stress is about to increase, not just when costs are changing.

How Should Companies Respond?

First, review weekly PADD-level wholesale data alongside your actual terminal mix, not national averages. Second, reassess retail price lag monthly during the heating season, even if formal price changes are uncomfortable. Third, align dispatch and purchasing so higher-cost supply is paired with routes that protect margin, not erode it. Fourth, communicate internally when price pressure is building so safety, staffing, and scheduling decisions can adjust before problems surface.

Pricing Discipline Pays Off

Weekly propane pricing trends are not about predicting the market. Rather, they are about maintaining discipline when conditions shift unevenly across various regions. Businesses that actively track PADD-level movement and tie it directly to their purchasing, pricing, and dispatch decisions tend to preserve margin and stability through volatile periods. Over time, that discipline reduces operational strain, limits safety risk, and supports more consistent financial performance, regardless of how unpredictable the weather or broader energy markets become.